If you’ve bought or sold a home in the past two years, you know the housing market has been on a wild ride. But the past six months have brought a major shift to the entire industry. We went from bidding wars and unprecedented buyer demand to a major cooldown that is causing more buyers sit on the sidelines.

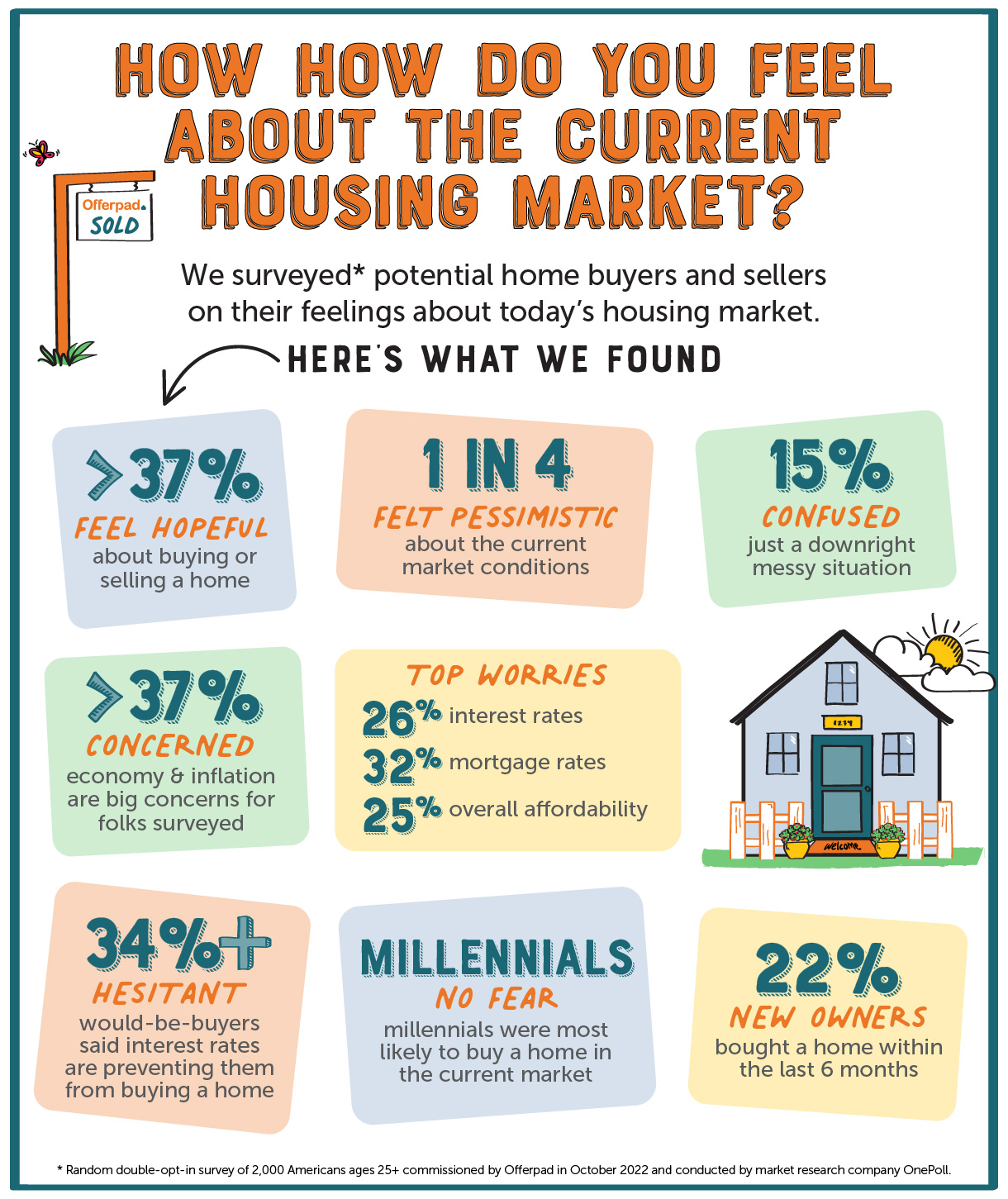

With so much uncertainty and differing predictions about where things are headed, we decided to dig deeper to find out how potential home buyers and sellers really feel about the state of the housing market. From a survey we recently commissioned we found that rising interest rates, inflation and affordability are the most common concerns.

Holding out hope

Despite ongoing challenges within the housing market, we found there are still a lot of optimists among us. More than a third (37%) of those surveyed still feel hopeful about the current housing market. One in 4 (26%) survey respondents feel pessimistic and 15% say they are just downright confused.

Inflation and interest rates top of mind for sellers

Of those who plan on selling a home in the next six months, more than a third (37%) said the economy and inflation were their biggest concerns. Interest rates were a top concern for 26% of those surveyed, followed by 25% of respondents who said overall affordability is their biggest worry.

Mortgage rates causing hesitancy for potential buyers

As mortgage rates continue to hover over 6%, nearly a third (32%) of survey respondents said high mortgage rates were their biggest concern, while 22% worry they’ll overpay for a home. In addition, commuting concerns were a cause giving folks in the West (27%) and Northeast (25%) pause about buying.

Interest rates impacting path to homeownership

Like home sellers, potential home buyers are also feeling the impact of rising interest rates. Over a third (34%) of would-be buyers said interest rates are preventing them from buying a home, with those living in the West (42%) the most likely to say interest rates are a downer when it comes to saving up for a down payment.

Millennials most likely to buy

While some buyers are waiting it out, millennials are the generation that’s most likely to buy a home in the current market environment. In fact, 22% of millennials surveyed said they had purchased a home in the last six months compared to just 7% of Gen X and 3% of baby boomers.

Looking for a much simpler path to homeownership? We got you. We can help you find and finance a new home and save you money while doing it. Check out our Bundle Rewards program to see how.3

Whether you want to buy, sell or need a home loan, we’re all about making your life simpler so you can do less ‘real estat-ing’ and more living.

Survey Methodology: Offerpad conducted a survey that collected responses from approximately 2,000 consumers between October 18 and October 24 across the United States.

*Not available in all states. Rates, terms, and availability subject to change without notice. Bundle Rewards delivered as buyer commission rebates, lender credits, reduced service fee, or seller credits. Potential rewards, savings and discounts will vary. All components of a bundle must be completed within 6-month period to qualify. Void where prohibited by law.